- Featured Magazines

- Let's Get Cooking!

- News, Politics, and Business

- Lifestyle Magazines

- Popular Magazines

- All Magazines

- See all

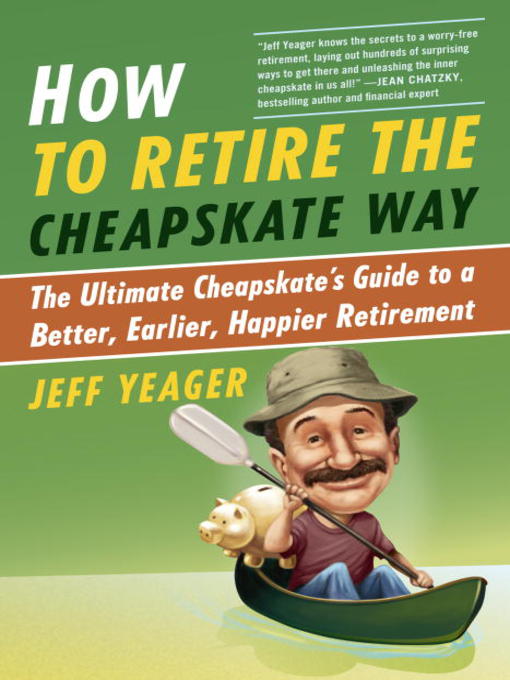

How to Retire the Cheapskate Way

The Ultimate Cheapskate's Guide to a Better, Earlier, Happier Retirement

Combining Yeager’s loveable humor and offbeat anecdotes that have garnered him an ever-growing fan base, How to Retire the Cheapskate Way shares with readers hundreds of retirement secrets and tips, including:

·How to Simple-size Your Way to a Better Retirement

·The 20 Secret Cheapskate Principles for Retiring Comfortably on Less...Maybe Even on Social Security Alone

·How to Survive the Medical Maelstrom (without resorting to DIY surgery at home)

·Plus Dozens of Fun Ways to Both Earn a Little Extra Income During Retirement and Painlessly Cut Your Expenses

Yeager, who serves as the official “Savings Expert” for AARP and its 40+ million members, weaves together both everyday practical tips and life-changing financial strategies with the real life stories of frugal retirees as well as people of all ages who are working toward a better, earlier, happier retirement The Cheapskate Way.

-

Creators

-

Publisher

-

Release date

January 1, 2013 -

Formats

-

Kindle Book

-

OverDrive Read

- ISBN: 9780307956439

-

EPUB ebook

- ISBN: 9780307956439

- File size: 3490 KB

-

-

Languages

- English

-

Reviews

-

Kirkus

October 15, 2012

Retirement may be a long way off for many, but according to Yeager (The Ultimate Cheapskate's Road Map to True Riches, 2007, etc.), there is never a better time to start thinking and preparing for that moment than the present. Full of practical advice and numerous stories of "cheapskates" who have retired early, this book prompts readers to reexamine how they spend their money. Believing that it's not how much money you make, but how you spend what you do have that makes the difference between an early retirement, free of debt, or a later one, full of money woes, the author gives simple and sound advice on how to live frugally. Covering topics such as health insurance, Medicaid and investing, Yeager hammers home the need to spend less and save more, whether by packing a bag lunch or forgoing that new car. On Social Security, he writes that readers should "NEVER PLAN to retire on your Social Security benefit alone--it's only designed to replace 30-40 percent of most people's preretirement income." Checklists help determine what makes a person happy, whether items can be sold or donated to charity, and what health risks older people encounter and how to prevent them. For those who want to continue to work past retirement, Yeager offers a long inventory of self-employment ideas. The ultimate goal is to determine what a person "really, really wants" out of life and then work toward that goal without faltering. Much of this information is not new, but by gathering it in one place, the author makes it much easier to step down from work debt-free. Useful information on frugality and retirement.COPYRIGHT(2012) Kirkus Reviews, ALL RIGHTS RESERVED.

-

Formats

- Kindle Book

- OverDrive Read

- EPUB ebook

subjects

Languages

- English

Loading

Why is availability limited?

×Availability can change throughout the month based on the library's budget. You can still place a hold on the title, and your hold will be automatically filled as soon as the title is available again.

The Kindle Book format for this title is not supported on:

×Read-along ebook

×The OverDrive Read format of this ebook has professional narration that plays while you read in your browser. Learn more here.